DANSKE Bank said deposits during the Covid-19 lockdown surged by £1 billion as consumers in the north tightened their purse strings.

Funds deposited in accounts hit £8.6 billion for the first half (H1) of 2020, a £1.4bn uplift on the same period last year, with a major spike in the second quarter.

The bank’s Belfast-based chief executive Kevin Kingston described the increase as “significant”.

He said unlocking such funds will be crucial over the coming months.

“If we are to get the Northern Ireland economy moving again, a lot will depend on how much of this pent up economic capacity turns into consumer spending and business investment,” he said.

The coronavirus pandemic dominated the bank’s financial results for the first six months of 2020.

Pre-tax profits plunged by 94 per cent in anticipation of the financial difficulties borrowers will suffer throughout the crisis.

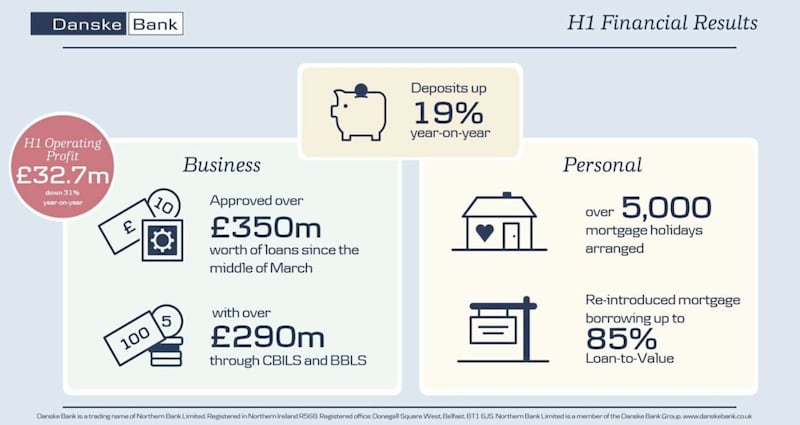

Danske Bank factored in £29.8m of loan impairments for the first half of 2020, taking profits from £32.7m to £2.9m.

It compares with a six-month pre-tax profit of £45.9m for the same period last year.

Loan impairments are typically used when banks doubt borrowers will be able to repay.

Commenting on the Northern Ireland end of its business, a report from the banking group’s Copenhagen headquarters said: “This was driven by provisions for potential future loan losses made as a result of the corona crisis.”

The bank’s operating profit in Northern Ireland was already down by a third to £32.7m in H1 before the impairments, largely due to a reduction in UK interest rates and lower activity levels.

Its income fell 12 per cent to £102.7m.

The north’s biggest bank said it approved £350m worth of coronavirus related business support loans since the middle of March, including £290m under UK Government backed loan schemes.

Kevin Kingston said there had been 8,500 local business funding approvals, with the volume of business lending during the crisis treble the what it was during same period last year.

Danske Bank granted mortgage repayment ‘holidays’ to 5,000 homeowners over the six months, along with 675 breaks on personal loans and credit cards.

The final report to be issued before the end of the Brexit transition period, the bank boss sounded a stern warning over the potential implications on the north’s “fragile” economy.

“Uncertainty around Brexit outcomes for Northern Ireland still prevail, and the business community and political representatives must continue to work closely together if we are to safeguard our fragile economy,” he said.