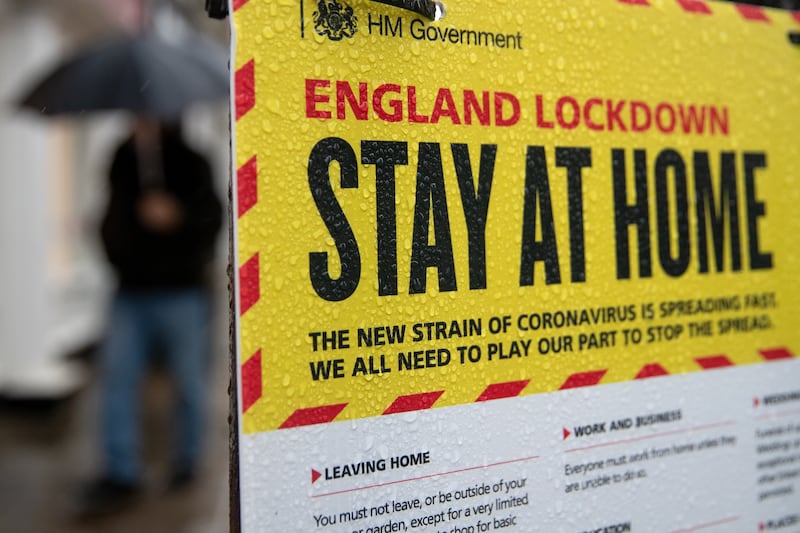

STORMONT is set to receive an extra £20 million in coronavirus support from the UK Government, raising hopes that the cash grant scheme for businesses could be expanded.

The funding, courtesy of the Barnett formula, follows Saturday’s announcement of an additional £617m for local authorities in England to bolster support grants for businesses.

The Department for Business, Energy and Industrial Strategy in London has asked English local authorities to prioritise businesses in shared spaces, regular market traders and small charity properties.

It has raised hopes that the cash grants being administered by Stormont could be expanded further to benefit sectors left outside the scope of the current schemes.

A spokesperson for the Department of Finance said: "Local authorities in England will be receiving up to an additional £617m which will result in a Barnett consequential of up to £20m for Northern Ireland.

“We cannot be more definitive on the figures at this stage as actual amounts will depend on uptake.

“Following this latest announcement, the Executive will receive total Barnett consequentials of up to £1.212 billion towards its Covid-19 response.”

Meanwhile the Irish Government has announced another €6.5 billion in support measures for businesses in the Republic.

A series of recovery funds were agreed in a special cabinet meeting on Saturday, after Taoiseach Leo Varadkar announced a five-stage road map to easing restrictions on Friday evening.

The measures include a €2bn pandemic stabilisation and recovery fund and a €2bn Covid-19 credit guarantee scheme to support lending to small and medium enterprises (SMEs) for terms ranging from three months to six years.

A €10,000 restart grant for micro and small businesses, a three-month commercial rates waiver for impacted businesses, the "warehousing" of tax liabilities for 12 months after recommencement of trading and a commitment to local authorities to make up the rates shortfall were also announced.

Finance minister Paschal Donohoe said the measures are designed to "minimise the damage" of the pandemic.

"Our collective public health has been targeted; our businesses and our economy have been shouldered with an unimaginable burden; and our society is grappling with this new reality. But, by working together, we are minimising the damage," he said.

"On top of the measures previously put in place by Government, this suite of measures being outlined today is designed to build confidence, further assist businesses in terms of the management of their companies, and allow them to begin looking to the future and start charting a path forward for weeks and months ahead."

The Government has already rolled out a multibillion-euro package of assistance for employers and workers during the crisis.

Around 450,000 workers are receiving state payments through a temporary wage subsidy scheme, while around another 600,000 have applied for a special Covid-19 unemployment benefit.

The Irish Government has also significantly expanded financial support for small and medium sized-businesses.