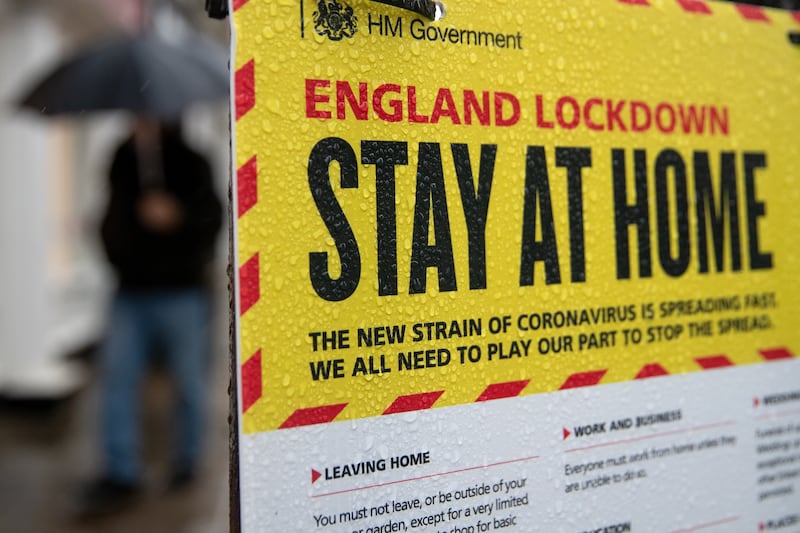

SOME of the north’s main banks have announced new measures for customers amid the coronavirus crisis.

It comes as the increase in the contactless limit to £45 is expected to come into widespread operation from today (April 1).

AIB has introduced a three month ‘payment holiday’ option on mortgage repayments, business loans and personal loans, to customers impacted by Covid-19.

The lender (formerly First Trust), said all its branches across the north are currently open as usual, but close for lunch from 12:30pm-1:30pm daily. AIB said customers can also use the Post Office for everyday banking transactions as they too remain open.

Adrian Moynihan, who heads AIB’s operation in the north, said: “We understand the pressures people are under now more than ever and we are ready to help with tailored customer solutions.

“On the ground, we are keeping our branches open and putting extra cleaning measures in place, as well as protections to minimise any potential impact on our customers and our staff.”

Bank of Ireland said its customers who are self-isolating – including older customers and those in vulnerable situations – can nominate another person to make in-branch cash withdrawals on their behalf. Customers need to can call 0800 783 8591 to avail of the service.

The opening hours of all Bank of Ireland UK branches in Northern Ireland have temporarily changed to 10am – 2pm Monday – Friday, due to the ongoing coronavirus situations and a significant fall in the number of customers visiting branches. A prioritised service for over 65’s and carers is being provided between 10am and 11am each day.

Ian McLaughlin, chief executive of Bank of Ireland UK said: “The ‘cocooning support’ will make it easier for a trusted friend or next-door neighbour to help those in isolation with their daily essentials.

“Many of our customers find themselves particularly vulnerable at the moment and relying more than ever on the help and support of others. ‘Cocooning support’ gives them one less thing to worry about, during what is a really challenging time.”

Meanwhile, Ulster Bank has said it will freeze overdraft interest at current rates for the next three months.

New rules on overdrafts from the Financial Conduct Authority (FCA) are due to come into effect from April 2020.

While the FCA says 70 per cent of overdraft users will be better off, but some customers with an arranged overdraft facility face an increase in costs.

Ulster Bank has said it is also removing all other overdraft fees and charges. It says that all customers who use their overdraft for the three months from March 30 2020 will pay less.

Les Matheson, chief executive of personal banking at Ulster Bank’s parent group RBS said: “We have taken the decision to freeze interest rates on our overdrafts in order to help our personal customers during this unpredictable and unprecedented time. All of our customers, using their overdrafts, will pay less under this single, lower rate of interest, for any size of overdraft, for at least three months, with no other associated fees and charges.”

Ulster Bank’s head of personal banking, Terry Robb, added: “We’re working hard to support customers and provide help to people, families and communities across Northern Ireland. As well as our branch network, customers can access banking services online, over the phone or via the mobile app, including our dedicate line for over 70s and those in extended isolation and NHS workers.”