IN recent weeks, a number of economic statistical releases have been published in Northern Ireland relating to both consumers and businesses.

On the consumer side, we’ve had data on people’s earnings and wellbeing, while for businesses, we now have the latest information on business birth and death rates, as well as on research and development (R&D) activities at local firms.

In each of these publications, there are some positives but also some negative points.

Beginning with consumers, the latest annual survey of hours and earnings revealed that, in nominal terms, weekly earnings for full-time workers in Northern Ireland increased by 3.3 per cent over the 12 months to April. This relatively high rate of wage growth was primarily driven by the strong performance of the local labour market.

When adjusted to account for inflation, the rate of growth of real weekly earnings over the year was 1.2 per cent. However, real earnings are still slightly below the levels they were at back in 2009.

It was encouraging to see the proportion of jobs considered to be ‘low-paid’ at its lowest level in 20 years this April, but despite the improvement in this measure, Northern Ireland still has a relatively larger proportion of low paid workers than all other regions of the UK.

When attempting to measure personal wellbeing, local people are asked for their opinions on life satisfaction, whether they feel what they are doing with their life is worthwhile, how happy they feel and their anxiety levels.

As in recent years, the latest wellbeing data (which covers the year ending March 2019) showed that people in Northern Ireland still had higher life satisfaction, stronger feelings that what they do is worthwhile and felt happier than people in England, Scotland and Wales.

But the new data also revealed a large increase in anxiety levels in Northern Ireland. The local anxiety score was joint with that in Scotland as the lowest across the four countries of the UK, but it was much closer to the overall UK average than in the last couple of years. I’ll return to why this might be shortly.

Turning to businesses, the latest business demography statistics showed that in 2018 the business death rate in Northern Ireland was the lowest of all the UK regions.

However, the local business birth rate was also the lowest among the regions of the UK. These figures also showed that Northern Ireland had the smallest share of high growth businesses at just 4.3 per cent. That compares with 5.0 per cent across the whole of the UK.

Last year, total research and development (R&D) spending in Northern Ireland amounted to £794 million. Businesses accounted for more than two thirds of that spending, higher education bodies made up more than a quarter of expenditure and the rest was made up by government departments.

Focusing on R&D conducted by businesses, the positives include the fact that there were more firms engaged in research and development and more employment associated with it in 2018. The number of business who undertook R&D activity was 7.1 per cent higher than in 2017. In terms of employment, there were also just over 8,000 full-time equivalents involved with R&D, almost 6 per cent higher than in the previous year and 67 per cent higher than in 2013.

But it wasn’t all good news. When considered in real terms, spending by businesses on R&D activities only grew by a miserly 0.1 per cent last year.

It’s true that there are some encouraging signs that we can draw from this collection of economic statistics, including the strong wage growth and the increase in the number of firms carrying out R&D activity. But, the figures also highlight a number of the key challenges facing the local economy.

One factor that links the earnings and R&D data is productivity. Low levels of productivity are a long-standing issue in Northern Ireland and, over the long-term, productivity increases are a key determinant of wage growth. There is no quick fix when it comes to boosting productivity levels but one potential way of attempting to increase output per hour is by investing more in research and development and encouraging firms to become more innovative. As such, we need to hope for sustained real terms increases in local businesses’ R&D spending in the years ahead.

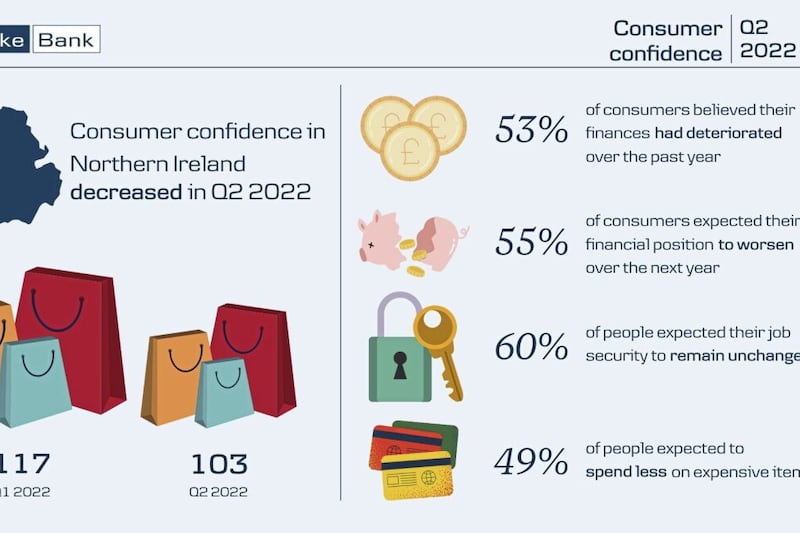

It is very difficult to say exactly what drove the increase in anxiety levels in Northern Ireland this year, but one possibility is the high level of Brexit-related uncertainty. Our Danske Bank NI consumer confidence index has shown that Brexit has adversely impacted consumer sentiment throughout 2019.

We also need to do more to encourage entrepreneurship in Northern Ireland and create an environment that supports more local firms to break into that cohort of high growth businesses.

These statistical publications are part of a collection of data releases that can be used to monitor and assess the economy. While GDP and economic output figures tend to get the most attention when it comes to measuring economic performance, other figures such as these can also provide valuable insights.

Looking across the latest numbers, the surveys discussed above paint a pretty mixed picture for consumers and businesses across Northern Ireland.

:: Conor Lambe is chief economist at Danske Bank

:: Next week: Paul McErlean