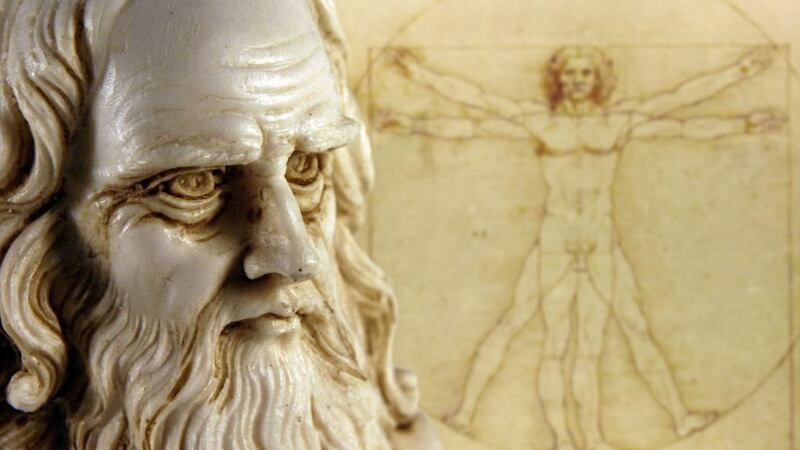

Leonardo da Vinci did not believe in mobile phones. Even the Renaissance genius who, besides a bit of painting and drawing, designed the first prototypes of the helicopter, the parachute and even scuba gear, did not predict microwave communications and mobile phones. They were just too far ahead.

It’s the same with us and our money. Changes now under way may mean that, by the time we finish working, the retirement market may have altered beyond all recognition.

A new report by the CBI says business owners have highlighted ongoing government tinkering with the pensions system as a huge concern. To quote the report: “After years of pension policy changes, nearly half of business leaders (48 per cent) identified regulatory stability as another key priority for government.”

In other words: hands off the pensions system for a while lads, give us all time to catch our breath.

Much of this tinkering has focussed on the state pension, which is important because most people see it as a crucial, for many the only, source of retirement income they will have.

The problem is that the state pension fund is like a massive water reservoir, it needs constant top-ups of rainfall in order to keep the levels up. The state pension depends on a massive inflow of contributions from working people, to maintain its obligations to those who are already drawing their pension out. We have mentioned this before – it’s called the ‘dependency ratio.’

It is changing, because the number of older, healthier people drawing out of the state pension is growing faster than the number of workers paying in.

The number of over-65s in Northern Ireland is expected to grow by 25 per cent by 2026, and the number of over-85s by 40 per cent. Average life expectancy a century ago was about 60; today it is 81.

The Department of Health said just last week that over the last five years alone, male longevity in Northern Ireland has increased by over nine months, most notably due to better treatments and preventions for the common killer, circulatory disease.

As a result, some observers are predicting that the dependency ratio will fall from 3:1 (three workers paying into the state pension for each worker taking their pension out) to closer to 1:1 by 2050. The state pension scheme is creaking under the weight of our longer lives and our longer retirements.

This is why the government tinkering we mention has included a programme of raising the age at which you can first draw your state pension. It used to be 60 for women and 65 for men, this year it’s 65 years and three months for both women and men, and it’s set to hit 66 for both men and women in October 2020.

Under the Pensions Act 2007, it will then rise to 67 between 2026 and 2028 and to 68 between 2044 and 2046. They say that our child or grandchild born this year may be 70, before they can draw their state pension.

What would Leonardo make of all this? As an excellent engineer and inventor, he had a deep understanding of opposing forces. I’m sure he’d agree that with the state pension facing such challenges, we should turn our attention to additional voluntary contributions, and to our workplace or personal pension, to prepare for any delays or restraints of state pension levels in the future.

The CBI agrees: almost all business leaders (93 per cent) are urging the government to ‘focus on employee engagement with their pension savings to boost voluntary contributions’.

Furthermore, three quarters (74 per cent) of businesses want to see automatic enrolment into a workplace pension made available to the self-employed and those earning less than £10,000.

Could this be the time for you to chat with us about boosting your own pension provision?

I’m sure if Leonardo were here, he’d be on his mobile straight away . . . .

:: Michael Kennedy and Shaun Doherty are independent financial advisers and pensions specialists, and can be contacted on 028 71886005 . Further information on Facebook at “Kennedy Independent Financial Advice Ltd” or at www.mkennedyfinancial.com