THE current level of Brexit related and general political uncertainty in the UK shows no signs of abating in the near future.

Our Barclays Investment Solutions team tells us uncertainty makes people nervous and can lead them to question if it’s the right time to make a decision, whether it’s “should you go to Europe on holiday this summer”, or “is now the right time to invest?”

‘Once in a generation’ changes are clearly afoot on the world stage and it is these changes which can make for uncomfortable headlines in the media. Because events are unfolding before our eyes, it can often feel like there is a higher degree of uncertainty than usual. However, uncertainty can’t keep on rising. So, what’s actually going on here?

There is a phenomenon called ‘retrospection bias.’ This is the tendency for human beings to look back at history with misty eyes. Because we can’t feel the uncertainty of the time, the past will always seem non-threatening. With the benefit of hindsight, we always see just one, often obvious, outcome.

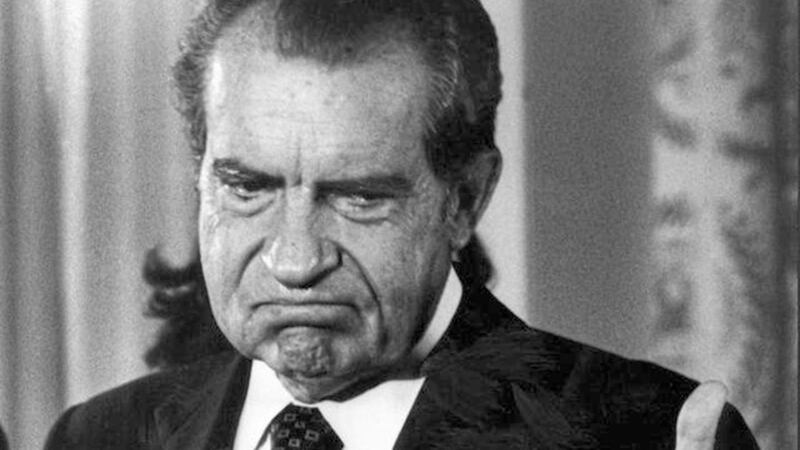

But consider the Cold War, when the Suez Crisis and Cuban Missile Crisis sparked international tensions; or the Watergate scandal, which led to a constitutional crisis, the commencement of an impeachment process, and the resignation of President Nixon.

These are just two examples of a long list of events where we cannot compare the level of uncertainty then to what we experience today. Events will always come and go. The best we can do, as investors, is to consider what these events may mean for the investment landscape.

A rational investor should demand a higher return when the outlook is uncertain or unfavourable. However, for those who prefer to wait out the uncertainty before investing, they risk waiting too long and potentially missing out altogether.

When investing for the long term, the best approach is to select a range of assets (such as shares, bonds, cash etc.) that provide a sufficiently attractive return, and diversify across those holdings.

The Barclays Ready-made Investments are just one example of a range of diversified funds, which allow you to select the level of risk you are most comfortable with. These multi-asset funds invest across a range of asset classes and regions, offering a globally diversified one-stop solution for investors.

You should only be thinking about holding these investments for at least five years as they’re designed for the long term.

All of these investments can fall in value as well rise; you may get back less than you invest.

:: Claire McCombe is a private banker at Barclays Wealth & Investments NI