OVER 40,000 Wonga customers are seeking compensation from the defunct payday lender, with administrators to the firm expecting the number to shoot up further.

Documents released by the Treasury Committee on Tuesday show that the number has mushroomed from a January estimate of 10,500 as more borrowers sold unaffordable loans come forward.

A letter from corporate undertakers at Grant Thornton to Committee chairwoman Nicky Morgan read: "The total number of redress claims is currently more than four times the number you referred to in your press statement on 26 February and we can expect this to increase, when the administrators publicly request claims from borrowers who believe they may have been sold an unaffordable loan."

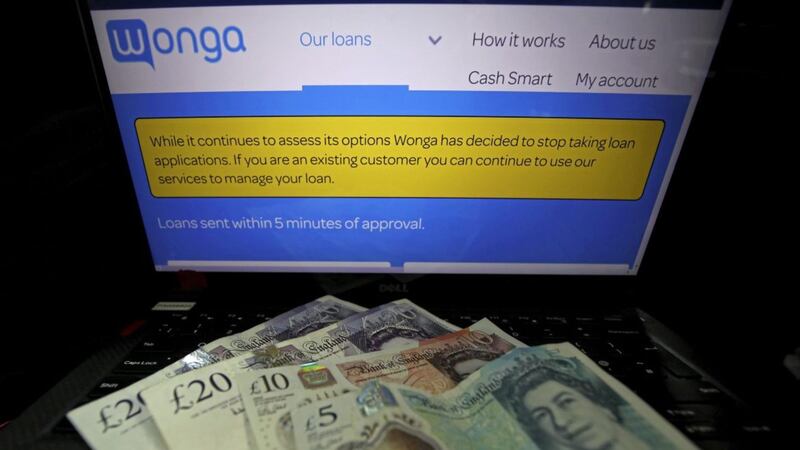

Wonga collapsed in August after it was hit by a surge in people making compensation claims over historical loans.

Mrs Morgan wrote to Grant Thornton to ask how the accountancy firm intends to progress outstanding complaints against Wonga.

Its boss Dave Dunckley responded saying that Grant Thornton will set up a portal for customers to make claims directly online, although there is currently no "go-live" date.

He also advised customers that using a claims management company will not accelerate the claims process, and may expose them to charges that will be deducted from any final payment they might receive.

Mrs Morgan said: "This problem is clearly much bigger than expected. It now appears that over 40,000 people - and rising - may have an unresolved complaint about being mis-sold loans.

"Wonga's creditors and claimants are now in the hands of an administration process, waiting to discover what their share of Wonga's assets will be, which could now be smaller as more people make claims."

The Tory MP also said that the Wonga saga raises questions about whether the coverage of the Financial Services Compensation Scheme should be widened to provide protection for customers of high-cost short-term lenders and those of firms that later go bust.

Caroline Wayman, chief ombudsman at the Financial Ombudsman Service, told the Committee in January that customers who had open complaints will not be able to have their issues resolved.

In addition, they will not be entitled to get their money back as high-cost short-term credit firms are not covered by the Financial Services Compensation Scheme (FSCS).

Mrs Morgan has been vocal about the treatment of Wonga customers and last month said they had been "left to fend for themselves" as they fall out of the regulator's remit.

She has said customers have been "cast aside" with no regulatory authority taking responsibility to deal with the complaints, and opened up the possibility of Government intervention.