MORE retailers could shut up shop in Belfast city centre in the wake of the Primark fire, a local property expert has warned.

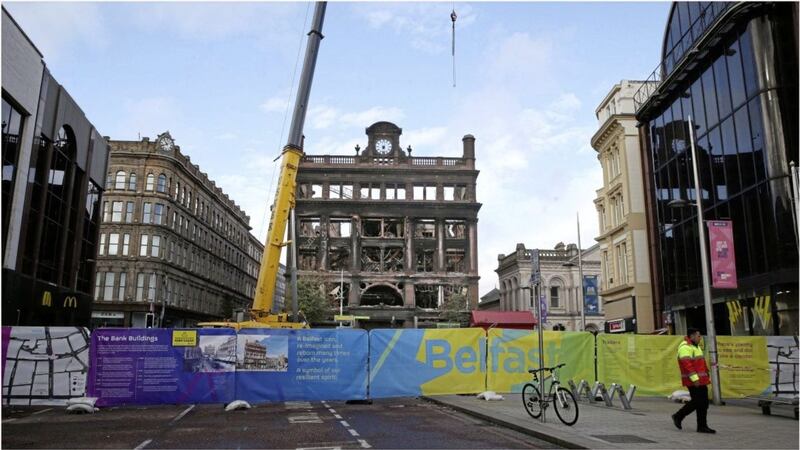

Declan Flynn, managing director of commercial real estate agency, Lisney believes we could see "further voids in the city" following the August 28 blaze as businesses follow the example of Ashers.

The bakery closed its Royal Avenue store last month due to a dramatic slump in footfall as a result of the fire.

Mr Flynn was speaking following the publication of Lisney's latest Northern Ireland Commercial Property Report, which revealed prime retail vacancy in Belfast has risen to 10.2 per cent, compared to 9 per cent last year.

Despite the challenging environment for retail, exacerbated by the Primark fire, Mr Flynn insists there is still some positivity within the sector.

“Whilst headlines from the retail sector have largely been dominated by the catastrophic disruption caused by the Bank Buildings blaze in Belfast, there is still activity in the market with Victoria Square welcoming Nespresso, Vans and Inglot, and Castlecourt announcing DV8, Matalan and Bestseller taking occupancy."

“Outside of Belfast, the Boulevard, Marlborough Retail Park, Rushmere, Crescent Link and Waterloo Place in Derry/Londonderry have seen positive letting momentum announcing deals with companies such as Kurt Geiger, Radley, Jack Wills, Five Guys and Skechers," he continued.

The report, which covers the three months to the end of September shows that refurbished stock accounted for three quarters of transactions within the north's office market, with no ‘new’ Grade A stock available for occupation this side of 2019.

Total investment volumes surpassed £70m in the third quarter of the year, with office investment dominating.

Major transactions included the the £15.2m sale of Obel 68 to Belfast Harbour and the sale of the Metro Building to a private family trust for £21.8m, in what is the biggest deal of the year so far.

Further high-profile sales across the office, retail and industrial markets could see investment volumes hit £200m by the end of the year according to Lisney.

A total of 385,000 sq ft of industrial transactions have been completed so far in 2018, but a lack of supply of assets has led to the majority of these transactions being lettings as opposed to owner occupiers purchasing properties.

Mr Lisney said the local office market is "encouraging", but a lack of stock remains an issue.

“Within the office market, the range of needs that require satisfying are vast," he explained.

“Supply will however be bolstered in 2019 with the arrival of refurbished stock at Chichester House and Merchant Square collectively bringing approximately 248,000 sq ft to the market. A planning decision is also expected for the proposed redevelopment of the former Belfast Telegraph building which would provide 230,000 sq ft of very welcome Grade A stock.

“The office sector has fuelled investments in 2018 with many transactions resulting in competitive bidding with a positive depth of local, national and international interest. This diversity of the investor base looking at and considering opportunities in Belfast is encouraging," Mr Flynn added.