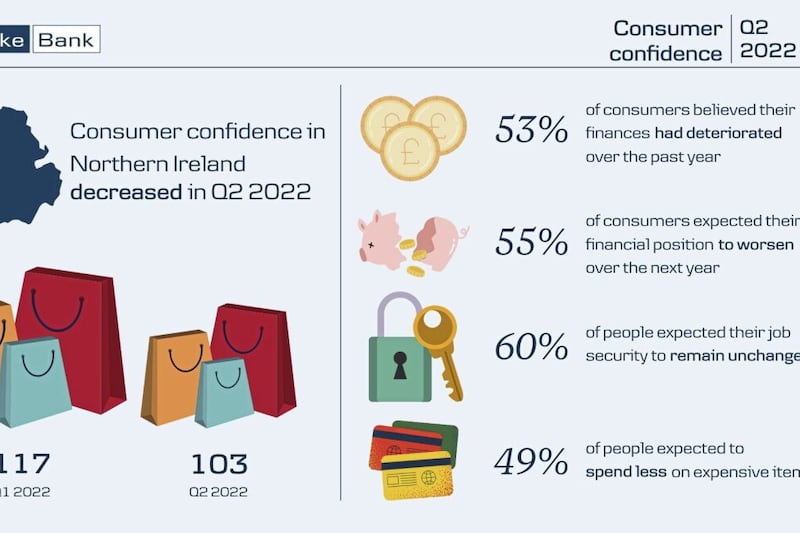

CONSUMER confidence in Northern Ireland has fallen sharply. The latest Danske Bank Northern Ireland Consumer Confidence Index reveals that sentiment dipped in the second quarter of this year, falling by 11 points compared with the first quarter of 2018 and by eight points compared with a year ago.

There were falls across all four components of the index. Consumers were less confident about their current finances, how they expect their financial position to change, their job security and the amount they expect to spend on expensive items over the next twelve months.

Digging deeper into the data further reveals some interesting findings about how different groups of society were feeling in the second quarter of the year.

In line with the way the headline index is constructed, we can get an idea of how confidence differs across groups by analysing the difference, or ‘balance’, between the proportion of people who felt optimistic and the proportion who felt pessimistic across the four different parts of the index.

And based on this analysis, three things stand out.

1 - Young people felt more confident than older people:

The most optimistic age group in society appears to be those aged 16-24. Across all four parts of the index, there was a larger share of people who felt better than worse, and by quite a bit too.

For example, 28 per cent of young people thought their financial position would get better over the next twelve months compared with just 10 per cent that thought it would get worse. And 30 per cent of respondents expected to spend more on high value goods and services in the year ahead while 16 per cent expected to spend less.

For 25-34 years olds, it’s a bit of a mixed bag. Regarding future finances, more people thought they would improve than thought they would deteriorate. For current finances and job security, there was a neutral balance meaning the percentage of people who felt better off was the same as those who felt worse off.

But for future spending, the balance was negative as more individuals felt pessimistic than optimistic. For the other age groups over 35, the balances were negative across the board.

2 - Women felt more pessimistic than men:

Across all parts of the index, the percentage of people that felt negative was greater than those who felt positive. That was the case for both men and women. But the negative balances were larger for women than for men in all instances.

The biggest differences occurred in the questions about an individual’s current financial position and on their job security. This is despite the fact that the latest labour market statistics show that the female unemployment rate in Northern Ireland is half the male unemployment rate.

While the male employment rate is higher than the female one, there has been a bigger percentage point increase in the female rate over the last year than in the male employment rate.

3 - The south was the most optimistic region and the north was the most pessimistic:

As part of the consumer confidence survey, we also look at the results broken down into four different regions within Northern Ireland – Belfast City along with North, South and West.

The latest data shows that consumers were most optimistic in the South region, which encompasses Lisburn, North Down, Newtownards, Newry & Mourne, Banbridge, Craigavon and Armagh. There were positive balances for all four parts of the index in this part of the country.

The region in which consumers were most pessimistic was the North, which covers Carrickfergus, Antrim, part of Newtownabbey, Ballymena, Larne, Moyle and Ballymoney. Across the different components of the index, the balances were negative and all quite large.

Consumer confidence is never identical across everyone in society. A deep dive into our latest data shows that there are a few groups of people with some optimism.

However, the message coming from the overall data is clear – factors such as political uncertainty, high inflation and Brexit are negatively weighing on confidence levels, as well as the wider Northern Ireland economy.

:: Conor Lambe is Danske Bank economist in Northern Ireland. Follow him on @ConorLambe

:: Next week: Brendan Mulgrew