IF you’ve got a lump sum of cash to invest or are concerned about your investments due to current global and UK events, how can you ensure you get the right return for your financial future?

New US President Donald Trump has wasted no time in making an impact during his first few days in office. Whether you like what he’s done or not depends on your political leaning, but it looks like we’re in for quite a ride.

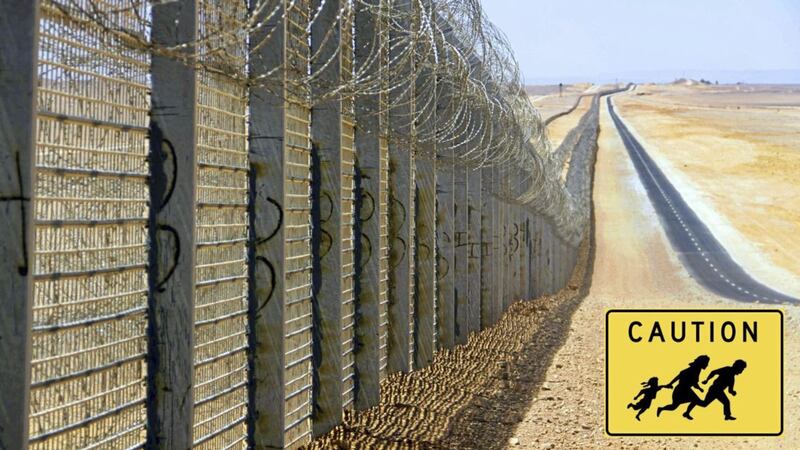

In his first week he has signed paperwork scrapping the Trans-Pacific Partnership, questioned climate change while promising an energy revolution, and now he’s going to get things started on the Mexican wall.

This side of the Atlantic, the Supreme Court has ruled that Parliament must vote to give Article 50 the go-ahead, which means MPs have to give their backing before the Prime Minister, Theresa May, can begin formal exit negotiations with the EU.

On top of this BT share price fell by 20 per cent in just a few hours, its biggest ever one day fall following news that an accounting scandal at its Italian business was worse than had been originally revealed. As a result, BT’s value fell by almost $8bn.

You could be forgiven for thinking that the best place to put a lump sum of cash is under your pillow. Some people might also feel concerned and make the decision to cash in their investments.

Well, before you make that choice, think about what else is going on.

The focus and noise has been on Trump and Brexit, but in the background the S&P 500 and Nasdaq closed with new records on Tuesday, January 24, while the Dow Jones edged towards 20,000 on the same day and the pound hit a six week high against the dollar.

So, what are the options?

When there’s a lot of uncertainty in the world, which we’ve seen with Trump and Brexit, one reaction for people to make is to jump out of the market as they think this will protect them.

Despite a turbulent 2016, the FTSE finished December on a record high, it could be the case that if you’re already in the market, it’s probably safer to be in rather than out.

The ubiquitous ‘Keep Calm and Carry On’ posters seem to be very relevant at the moment. While the World keeps changing and the noise, including alternative facts and post truth, get louder, you have a chance to try and cut through it.

If you want to invest then it’s worth working with an independent financial adviser. They will be able to ask you the questions to understand your risk profile, then advise you on what you can do with your funds.

:: Darren McKeever (dmckeever@wwfp.net) is Northern Ireland adviser of Worldwide Financial Planning, which is authorised and regulated by the Financial Conduct Authority. For a free, no obligation initial chat about your individual finances, call 028 6863 2692, email info@wwfp.net or click on www.wwfp.net. Follow us on Twitter: @WorldwideFP.