THE Footsie closed higher, lifted by bank stocks that jumped after clearing the latest Bank of England stress tests.

All seven of the UK's largest lenders passed the bank's tests, although Royal Bank of Scotland (RBS) and Standard Chartered fell short on some measures.

The FTSE 100 Index rose 39.6 points to 6395.7, after the BoE reported that the UK's banks were essentially resilient.

Germany's Dax and the Cac 40 in France were around one per cent lower. In New York, the Dow Jones Industrial Average was up more than 100 points in early trading.

The pound was a cent lower against the euro at just 1.42, as traders wait for the European Central Bank meeting later this week, which is expected to launch a further round of quantitative easing. Sterling was slightly higher against the dollar, at just under 1.51.

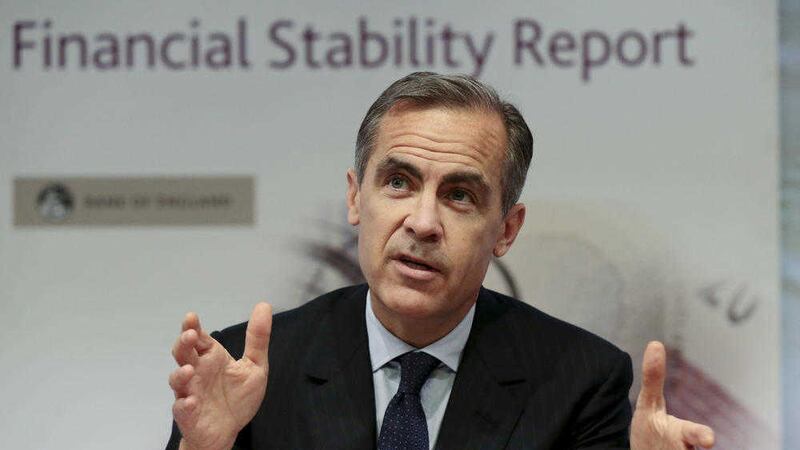

Lenders received a further boost when the bank's six-monthly Financial Stability Report said the UK's financial system has moved out of the "post-crisis period" and was not showing enough signs of overheating to require action to rein back credit conditions.

RBS lifted 9.8p to 312.2p despite its shortfall, although Standard Chartered slipped 0.5p to 556.7p.

Both of these banks did not have enough capital strength to meet some of the measures laid down as part of the annual MoT of lenders' capacity to deal with financial shocks.

But BoE allowed the pair of lenders to pass the overall test after considering steps they had taken to shore up their central reserves and crisis survival strategies.

Barclays was the biggest riser in the top flight, up 10.3p to 233.5p, and Lloyds Banking Group was 1.8p higher at 74.7p, as investors' fears were calmed over dividends being cut to boost capital reserves.

Alton Towers owner Merlin Entertainments lifted 5.8p to 415p, after it said in a trading statement it expected its underlying profit before tax for 2015 to be broadly in line with last year.

In June five people were seriously injured in a roller coaster accident at Alton Towers, and the firm said trading at that theme park was still significantly down.

But it added that a Halloween event at the park helped the decline narrow in recent weeks compared to a year ago.

Heavyweight mining stocks also rose on the back of encouraging overnight manufacturing data from China, the world's second biggest economy.

BHP Billiton climbed 15.8p to 812.7p, Rio Tinto lifted 6p to 2214.5p and Fresnillo was up 7.5p to 722.5p.

The biggest risers on the FTSE 100 Index were Barclays, up 10.3p at 233.5p, TUI, up 37p at 1139p, RBS up 9.8p at 312.2p and Hammerson up 17p at 627.5p.

The biggest fallers on the FTSE 100 Index were Glencore, down 2.2p at 94.5p, Sage Group, down 10p at 576.5p, Aberdeen Asset Management, down 4.6p at 314.8p and Babcock International, down 15p at 1056p.